A painless method to achieve financial success and travel

When it comes to planning your travel finances, before any action you need to set the basics straight. It means you need to have 7 pillar actions clear as crystal in your mind and daily life. They are:

- To have a travel and financial plan

- To picture your finances now

- To organize your finances

- To spend less

- To make extra money

- To invest your money

- To learn some travel hacks

But how to execute them? How not to give up in the middle? Keep reading and find out a complete method that will make your dream vacation come true no matter how much money you have today.

You may notice that this thing of “financial method” is not any specific about traveling. You are right! Before thinking of separate ideas about how to save for your trip, you need a method. A lot of this may be applied to any circumstance where you need more money than you have today. So, let’s do this!

1. How to build a travel and financial plan

Set specific goals

When asked about goals, most people tend to be excessively vague or abstract. The first step towards financial success applied to anything is to have goals as detailed as possible.

What is “a goal”?

A goal is neither a dream nor a wish. A goal is a target with a clear, realistic and achievable outcome. It has “what”, “when”, “where” and, most importantly, “why”.

Examples of travel dreams

“I want to travel”

“I wish to travel the world”

“I wish I could travel next summer”

Examples of travel goals

“I’m sure I will spend an awesome Christmas and New Year in Lapland with my best friend. We will be there for a week and will experience nature as never before. Lapland has been in my dreams for years and I never imagined I could do it. This time this wish will be fulfilled.”

“I will backpack in Southeast Asia for five months next year, starting in Thailand and finishing in Myanmar. My partner and I wish to visit at least 2 countries per month. We want to do this as the last big trip before having kids.”

“I want to hop around the Greek Islands for at least 10 days next summer. I always wanted to go to these islands, specifically Santorini and Crete, and as I’ve worked so much for the last year, I really want to enjoy these sunny holidays.”

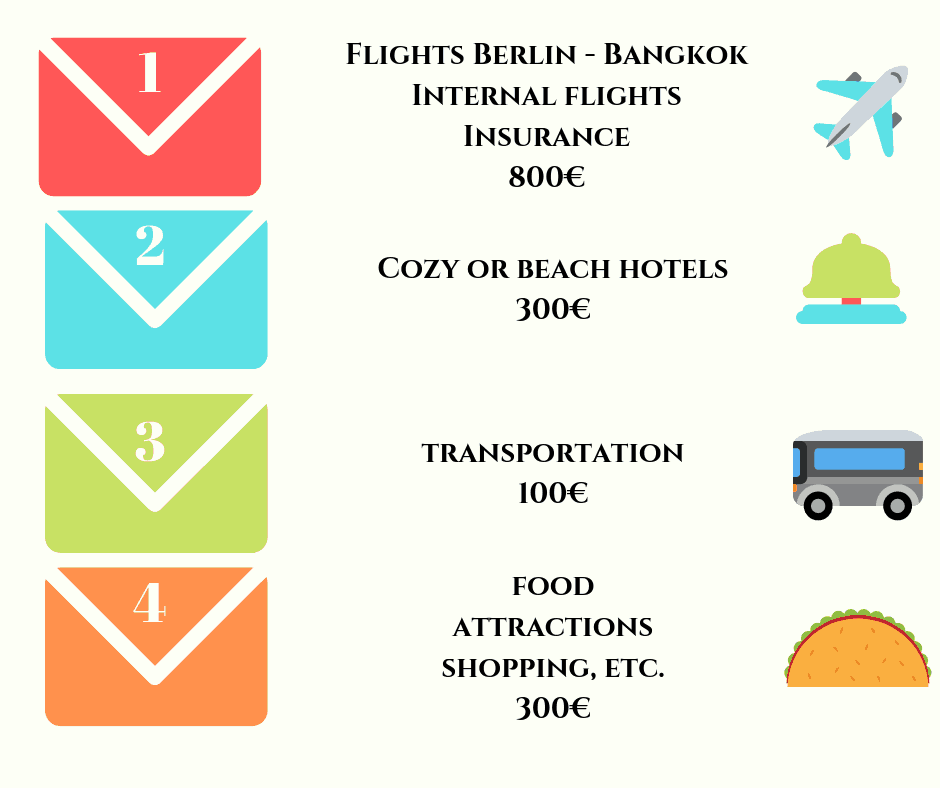

Calculating the budget

Now define goals about the finances of your trip. Once you have an idea of where you want to head to and when you will need to calculate the costs of:

- Flights, trains or car rental: book at least 2 months before departure

- Accommodation: hotels, hostels, Airbnb, couch-surfing

- Food: both restaurants and food from supermarkets.

- Leisure, museums, monuments

- Transportation

- Travel insurance

- Shopping

- And everything else you see you’ll spend money with

Of course, the prices of flying or transportation may vary a lot. So take a look TODAY at our flight search engine trying a couple of different dates to have an idea of overall prices. Then add up around 30% to that price. That will be the top price you will be willing to pay for those tickets.

[tp_search_shortcodes]Generated widget code has invalid value

Calculate prices of hotels, car rental, trains, leisure, etc., by checking on our partners. They are reliable companies with good or excellent prices.

An important point is that if you are very short in cash, choose destinations that are affordable and proportional to your capabilities of saving and generating extra income to travel.

A visual trigger for financial success

- The next step is to write all the items and their prices on an excel sheet and make a total sum.

- Then you download our Travel Budget Template, an excel sheet especially created for your trip planning.

- Then divide the total sum for the number of months you have for the trip

- And finally, divide the monthly amount for 4. Then you’ll have a very good idea of how much money you should save or get extra each week to make your goal come true.

- The next step is to make a beautiful paper poster with these goals and put it in a very visible place at home or office.

- Make yourself see your financial travel goals and budget every single day.

The point here is to see clearly where you want to go (if you have pictures to add, much better) and how much money you need to get. This is not bullshit. This is financial psychology. You can also take pictures of the poster and fix it as your computer or mobile screensaver, for example.

*** TIP ***

As you probably know, every country has its high season and low season. If you can, try to travel in mid-season time. First, because temperatures are neither extreme up nor down. Second because prices are generally lower in-between main seasons. Although flight prices vary a lot, you’ll likely be able to catch better prices in April-May and September-November.

2. Have a picture of your finances now

Before going hands-on in planning your trip and after knowing how much your holiday will cost, you need to know your real starting point. Ask yourself these questions and write them down on your travel excel file:

- How much money do you make every month? If your earnings vary, take the average of the last 3 months.

- What are your expenses in a typical month? If there are many variations, take the average of the last 3 months.

- How much money do you save or invest every month? If there are many variations, take the average of the last 3 months.

If you are in green numbers, congratulations! However, you won´t use your savings for this travel plan. The idea is to save extra, right?

3. How to organize your finances to travel

The first thing when organizing finances is to… organize them! You already know how much you make every month (or on average). And you already know how much you need to get, both monthly and weekly, to have that dream vacation. Now you need to build self-awareness about each step of the way. Let’s see some simple yet effective techniques.

Hide money from yourself

This is basic in personal finances: when you want to save some money or pay a loan, you EXCLUDE that amount of your wallet or bank account right at the beginning of the month. What does it mean? That when you have something that you feel obliged to pay for, you don´t expect the whole month to run and only then to separate that amount – you put it apart on day 1.

As you already know how much your expenses are and your income, you actually know how much you’ll be able to save, right? So put an amount out, specifically for your vacation, just when the month starts. Where will you take that amount from? From what’s superfluous in an average month.

Don’t worry: you won’t miss that amount. Your brain will work to make you reach month’s end without going broke.

But where do you put that money in?

In the safest place possible: away from you and your impulses.

The “envelope technique” applied to travel

This is quite simple: have envelopes with your goals written on them and the cost of the goal. You can use these for all your financial goals, but in this case, you will write down your travel goals.

You don’t need to make envelopes for all your costs. Prepare a few envelopes, naming the costs of things you can’t negotiate much and putting all you’ll be able to negotiate in one single envelope. Something like this:

The last envelope is the one you have room to make sacrifices if needed.

So every penny you save for the trip, you can either put it in cash there (if you live in a country with a stable economy, of course) or you send it to a bank account (preferably separate from your main account). If you separate an amount in a bank or savings account, write how much on a paper and put that paper in your envelope. Every one or two weeks, check your envelope to hold your progress accountable and motivate yourself to keep going.

***TIP***

If you put cash there, remember to keep those envelopes at a safe distance, and more if you have problems in holding your impulses. Use alluring pictures of your travel destination on the envelope so that you SEE what you’ll be missing in case you violate them.

Personal finance apps to save your vacation

There is a bunch of apps to help you stick to your budget and don’t lose control of your expenses. We personally like (and use) Airtable, both in mobile and desktop versions. It’s easy-to-use and the free version is an excellent way to start dominating your spending.

This article of Investopedia sorts out 8 other apps to keep control of your personal finances. Worth checking it.

A debit card to organize yourself better

There are lots of digital banks now that offer their services for (nearly) zero fees – and zero physical offices. One big advantage of them is to offer much better exchange rates than traditional banks. What does it mean? That if you travel to a country with another currency, you’ll spend LESS there than you would by using your current credit card or by withdrawing money directly from your bank account.

Some examples of this kind of banks in Europe are N26 and Revolut. The principle is easy: you fill their debit card with money from your traditional account. The transfer is done immediately, seconds later. With your debit card topped up, you may change the currency at an excellent rate (generally they offer from the official rate to 1 or 2 cents more expensive; a traditional bank generally charges way more than that).

But this is for when you are already traveling. At the point of financial planning, you may use this kind of card to put your money away from your eyes. In other words, to hide it from you. (Of course, after loading the card with your travel money, you literally hide it till next month. Don’t take it with you in your everyday life).

4. How to spend less on everyday life

There are two ways of getting more money licitly and within your realistic possibilities. The first is not only stick to your budget but to spend less. Having a minimalist mindset will surely help you A LOT in saving for travel.

When you start reducing costs, you’ll notice that you can perfectly live with that. If you feel like spending on something superfluous, make a simple calculation:

- How much I spend this time.

- How much I spend in a month if I give up

- How much I spend in a year if I give up

The classic example of 1 coffee a day with workmates. Saving 2€ a day means more than 500€ in a year (!!!). Yes, control yourself and stick to your budget.

13 Ideas (that work!) to stop wasting money

- Eat out less

Park your laziness away and cook your own meals. If you eat out every day at work, take your own food at least 2 days a week. If you are used to having dinner twice a week, do it only once. If you end up ordering food… go to the kitchen and cook! Besides being healthier, cooking may be a relaxing time as well.

- Spend more nights in

Enjoy your nest more, dedicate yourself to make it a place you want to be in. If you go out a lot, reduce that to at least half. And when you go out, set an amount you can spend and stick to it. Don’t mind if your friends bully you for not wasting your money. Tell them you have goals set and you appreciate if they can help you stick to your budget.

- Opt for free activities

Your city probably has a bunch of cool activities that are free of cost (or nearly free). Search and enjoy yourself!

- Buy clothes only during sales season

Never again buy clothes during an ordinary season or by impulse. Actually, set your shopping time as twice a year: during summer and winter sales.

***TIP***

Unsubscribe from all the e-commerce newsletters you are receiving often with tempting “offers”. If you want to save even more, buy your summer clothes in the winter before, and vice-versa, in outlets.

- Ask for discounts

Some people are ashamed of asking for discounts. Some are not. The second group is more likely to save up faster.

Remember: the worst outcome of asking for a discount is to get a “no”, and that´s it.

- Reduce your utility bills

Household appliances, especially the ones for heating and cooling, spend a LOT of energy. According to Visual Capitalist, the average electricity spend in America is $1,368.36 per year, and 35% of the power used is actually wasted (!!!).

Check this amazing infographic by Connect4Climate to see what appliances are draining the savings from your dream vacation. After being shocked, study where you can reduce your spending.

- Be wise with your grocery expenses

Although eating less and living a frugal lifestyle is way healthier, we are not asking you to stop eating. On the contrary: eat better both nutritionally and financially.

How to do that?

- Research for better prices both in supermarkets, local markets, co-ops

- If quality is ok, buy white label brands

- Buy bundles whenever possible, like cleaning and hygiene products

- Accumulate points and coupons from supermarkets and other retail stores – only do this if the reward is discounts or cashback

- Eat less and drink more water

- Prefer nutritious fulfilling food with NO SUGAR added. Examples: almonds, oats, nuts. They will help you control anxiety for food and eat less.

- Kick-off the day with a large nutritious breakfast.

- Never ever take candies with you. By the way, you should cut sugar straight from your diet. It’ll help you be less anxious and more focused, which will contribute to achieving your travel goals.

- As said before: cook at home.

- Get your hair and nails done less often

Learn how to do your grooming (nails, waxing) yourself. Research for better prices if you decide you don’t have any skill for that. And do it less often (without impacting your self-esteem, of course).

- Less car, more public transportation (and car-sharing)

It obviously depends on your city’s public transportation system, but evaluate the possibility of using your car less and relying on bus, metro, bike, Uber-ish solutions or even car-pooling.

- Cancel underused memberships and subscriptions

Take a close look at all your recurrent expenses. You’ll probably see you have a considerable number of memberships and subscriptions, and some of them are underused, useless or unnecessary at the moment. Cancel them! Examples:

- Cable and/or streaming services (Netflix, Spotify, Amazon Prime Video, etc.)

- Gym

- Charities or NGOs

- Phone landline

- Google storage, iCloud

- Research for better prices in your utilities or mobile/internet plan

Compare prices and change companies if you have better offers. As simple as that.

- Reduce your bank taxes and fees

It’s not uncommon that banks charge for fees they shouldn’t. Check your monthly extract in search of those. Additionally, research if other banks offer better fees than yours. In case you find those, go to your bank and negotiate for a counter-offer. In case they don’t up their game, change banks.

- Throw your credit cards away

If you have more than one credit card (apart from the debit card from a digital bank as we stated before), seriously consider throwing the others away or hiding them from yourself. The fewer means to buy, the better at this point of your saving journey.

*** TIP ***

When you feel like wasting money, remember your travel goals: take a look at your poster. That’s why it’s important to have your goals fresh in your mind. So put them anywhere you can: on your walls, on your passwords (“Greekislandstrip2020”), on your mobile, on your computer, etc.

- Bonus Idea

Use a rewards credit card and loyalty programs to save up points or miles. If you live in a country where you are rewarded with points or miles for simply using a credit card, take it! Research for loyalty programs that blend into your lifestyle and that DO NOT increase your consumption level. There’s no sense in spending more money to collect points. You should collect points with your reduced consumption level.

5. How to make more money

You know how much money you make every month, you have a clear idea of how much your trip will cost and you are aware of the time you have until your trip. Besides, you are determined to save money every month. Now you should be determined in making extra money. It’s not only a matter of reducing your costs but improving your income.

Ideas to increase your income

- Have a freelance work or a side job

There’s no trick here: work more to make more. Tell your friends, send CVs, proactively search for small jobs that’ll bring welcome money straight to your goals envelopes. Typical small gigs you can do from your home or not in an office are:

- Translation

- Copywriting

- Social media and community management

- Data entry

- Private teacher

- Dog-walking

- Pet-sitting

- Babysitting

You can search for these and other gigs at platforms like Upwork.

- Sell unused goods

Maybe you are not aware now but you certainly have something at home that is unused and in a good state, which qualifies them to be an extra money maker. Yes, sell clothes, shoes, appliances, books, jewelry, accessories and everything else that is in good shape and that you don´t use.in

You can sell these on platforms like Vinted.

- Take money, not gifts

A few weeks before your birthday and if you intend to celebrate it, gently tell your friends that you have a strong goal to accomplish until “x” time and that you need all their support. That’s why you thank in advance their willingness to celebrate your birthday with you and that you prefer an amount of money of their choice instead of a traditional gift.

6. To invest or not to invest?

Depending on the country where you live and your knowledge base about finances, you can not only keep the money you’ve been saving plus the extra money made, but you can also make it grow.

At this point, we suggest you be conservative in your investments. Reason: you wish to travel in “x” time and can’t afford to lose ANY money. So, neither shares, options nor hedge funds.

Which financial products can you invest in aiming at your dream vacation?

You can invest in the boring yet safer ones: savings account or pre-fixed bonds (depending on the country you live, this may be more or less attractive).

Whenever you find a good place to invest your dream vacation money, just go for it! Even if you have only a couple of months for the trip, study the case. You’ll probably benefit from it even if it’s for a short time.

7. Bonus tip: Learn some travel hacks

While getting good in saving and investing money with the greatest goal of having the trips of your dreams, it is a good idea to master the arts of travel hacking. This will make you stretch out your savings and expand your travel limits.

There are dozen of travel hacks out there but you can surely start with exploring possibilities with loyalty programs, cash-back programs or booking tickets and accommodation in the most optimal time.

The ultimate goal is to reduce the price of traveling as much as possible without sacrificing the quality of your experience.